Required disclosure filings

CalSTRS disclosure forms 600-H & 600-J

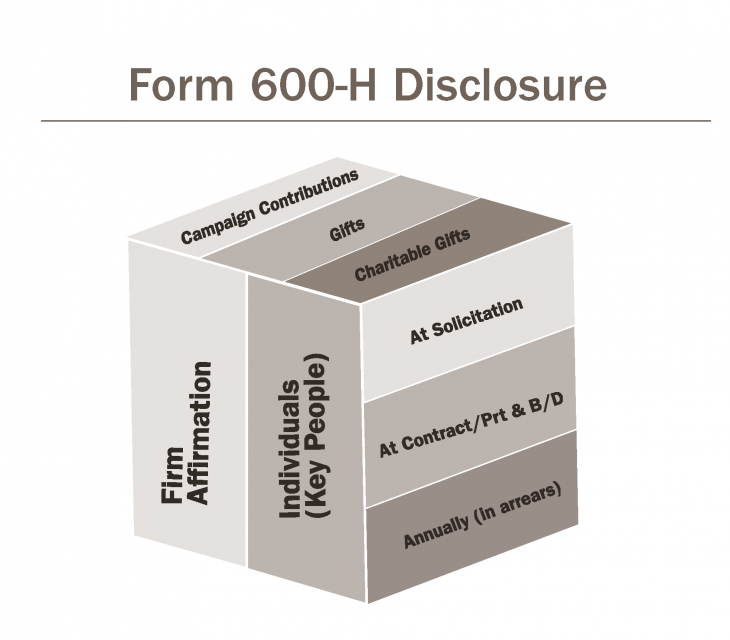

The Form 600-H – Disclosure of Contributions and Gifts is required to provide CalSTRS with conflict of interest information for current and incoming external business partners, except for subscriptions. This form is required for all external key personnel and firms.

The illustration shows the primary components of the Form 600-H disclosure.

The Form 600-J – Disclosure of Placement Agent Relationships is required to provide CalSTRS with information about the marketers serving as lobbyist placement agents for incoming external business partners.

Restrictions

CalSTRS Policy on Disclosure of Contributions and Gifts (Teachers’ Retirement Board Policy Manual, §600-H) sets forth restrictions on campaign contributions, charitable contributions and gifts made to CalSTRS officers or employees, or CalSTRS board members (or candidates for board member, Controller, Treasurer or Superintendent of Public Instruction) by entities engaging in business with CalSTRS for gain. Additionally, if you are interested in doing business with CalSTRS, your firm is subject to restrictions on campaign contributions set forth in the California Code of Regulations 5 C.C.R. §24010-24013). Subscriptions are exempt.

Teachers’ Retirement Board Policy Manual, §600-HWhat information must be filed

Entities/firms and their key personnel are required to report the following:

- Campaign contributions in excess of $250. If the business is an investment relationship, disclosure of campaign contributions made to the Governor or candidates for governorship must also be made.

- Charitable contributions in excess of $250, to a charitable entity that were made at the request of any CalSTRS board member, officer or employee staff.

- Gifts (including meals, entertainment and tangible items) greater than $50.

Who must file

To ensure compliance with the above policy and regulations, a Form 600-H – Disclosure of Contributions and Gifts is required on behalf of the firm/entity/broker-dealer and all Key Personnel during all filing stages.

For the definition of Key Personnel please refer to the Teachers’ Retirement Board Manual Section 4(G): Third-Party Economic Interest Disclosure Policy Definitions. In the CalSTRS Disclosure Compliance Portal, each filing will be clearly listed for each key personnel and firm.

Filing stages

There are three stages in which key personnel and the firm/entity/broker-dealer are required to report contributions and gifts, including but not limited to the following:

Stage 1: Solicitation

(During the due diligence phase –firm is new to CalSTRS or existing firm presents a newly proposed investment opportunity)

- Please complete the Form 600-H – Disclosure of Contributions and Gifts within 30 business days of receiving a Solicitation Packet from CalSTRS staff within the CalSTRS Disclosure Compliance Portal.

- Please note these forms will only be reviewed if your entity/firm has interacted or met with CalSTRS staff and an official email was sent to you requesting this submission.

Stage 2: Contract Execution or Broker-Dealer approval phase

- State Contracting Process: If your firm is entering into a formal Contract, Alternative Solicitation Contract or a Solicitation to Contract with CalSTRS, the Procurement office will work directly with you to obtain these required forms. Subscriptions are excluded.

- Partnerships/Joint Ventures etc.: If you are entering into a new Investment opportunity/commitment with CalSTRS and it has been 30 days or more since you submitted your Annual or Solicitation filing, you are required to file updated forms. Otherwise, you may provide CalSTRS with an email confirming that you have no changes to your disclosure reporting.

- Broker/Dealer Services: If your entity/firm provides only broker/dealer services to CalSTRS, you are required to file at Contract.

Stage 3: Annually thereafter (covering the prior calendar year) due April 1

CalSTRS staff will send you an email request, typically mid-January, requesting that you file on behalf of your firm/entity and for each of the key individuals identified for the prior calendar year.

Each filing stage will have its own Disclosure Task Group within the CalSTRS Disclosure Compliance portal. Please see submission section at the bottom of the page.

Since 2011, California law has required all placement agents and many internal marketing employees to register as lobbyists. Please refer to the Fair Political Practices Commission and Secretary of State websites for additional information.

Additionally, CalSTRS has a policy regarding the Disclosure of Placement Agents and Payments (Teachers’ Retirement Board Policy Manual, §600-J), which requires firms/entities to file a Form 600-J – Disclosure of Placement Agent Relationships prior to entering into any investment transaction or investment management contract with CalSTRS.

Teachers’ Retirement Board Policy Manual, §600-JThis disclosure of placement agent relationships includes any internal marketing staff or third party that assisted with the solicitation or the retention of CalSTRS as a client and any fees payable to the placement agent as a result of the relationship. Fees payable, for purposes for this request, include, but are not limited to:

- Placement agent fees

- Solicitation fees

- Referral fees

- Promotion fees

- Introduction to matchmaker fees

- Internal marketing incentives

If a placement agent (internal/external) party is participating or will be involved in this investment opportunity, you must complete the entire Form 600-J – Disclosure of Placement Agent Relationships. If your firm is not using a placement agent, your firm/entity should answer the minimum required questions by the Investment Office in the form. If you are entering into a contract through the CalSTRS Procurement process, the entire form is required to be completed.

If your firm discloses placement agent external fees paid, your entity/firm will be required to provide updated fees, requested quarterly, until completed. In addition, annually a Form 600-H will be required by any identified placement agents to disclose any campaign contributions and gifts made during the prior calendar year.

Submission of Form 600-H and Form 600-J

All CalSTRS-related disclosures must be submitted via the CalSTRS Disclosure Compliance (DC) Portal. Refer to the below links to gain company access and/or create an account.

- For firm entering a solicitation with CalSTRS: Solicitation Request.

- For firm executing a contract/agreement with CalSTRS: New Contract Request.

- To request a new account for an existing firm account: User Access Request.

Please submit any questions regarding these forms by email at InvestmentCompliance@CalSTRS.com.